Understanding the VAT Increase in South Africa

This year 2025, South Africa has just implemented an increase in value-added tax (VAT), making the rate raised from 15% to 15.5% effected on May 1st 2025. This new adjustment aims to elevate public revenue but it has significant implications for various sectors in the market, particularly in the importation field of goods from other countries. Business owners and consumers alike must stay informed closely about these changes as they are reverberating throughout the economy worldwide even.

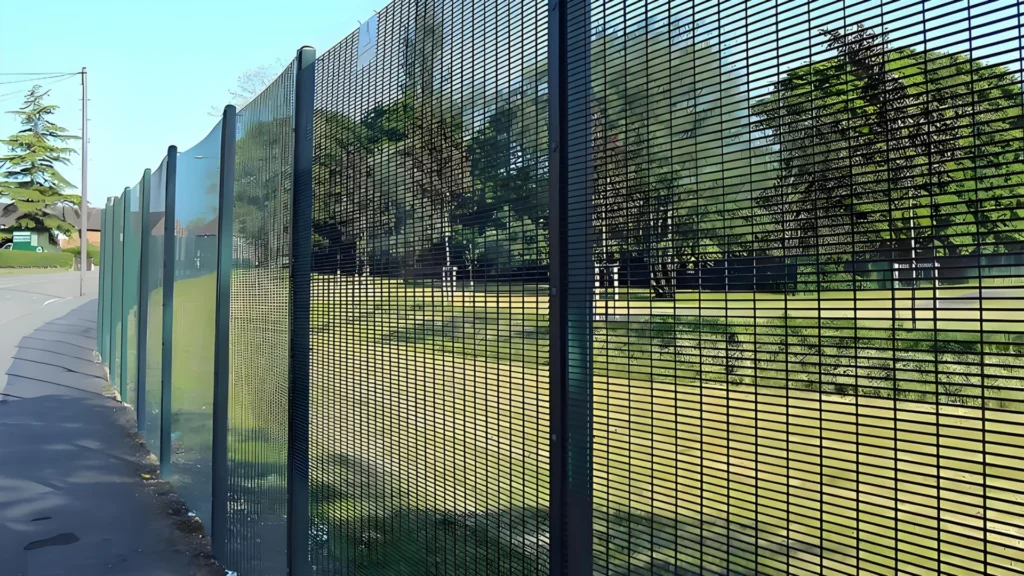

How VAT Affects the Import of Metal Fencing Products

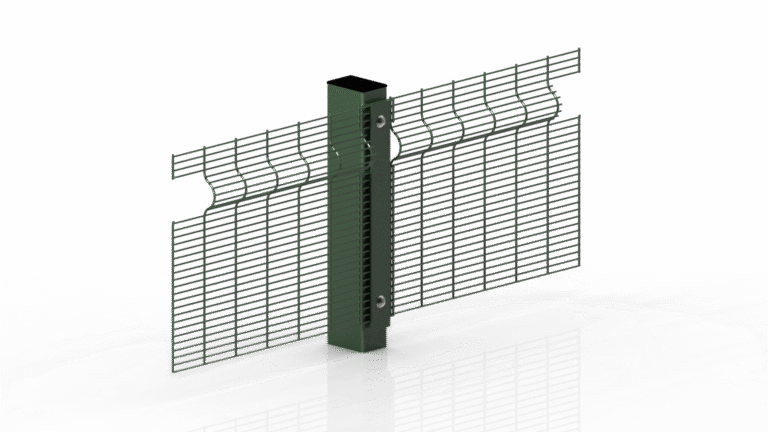

The increasing in VAT directly has influenced the cost of importing products, including metal fencing from China. Importers have to face a little higher,only 0.5% overall cost structure, which may lead to increased retail prices for consumers but not much difference.The importer can more value price to minus the value added tax. So by understanding these tax implications is vital for stakeholders in the construction and security sectors, you will know how to cope with that.

Strategies to Mitigate the Impact of the VAT Increase

Business owners who are importing metal fencing products from China Fence Company can adopt several strategies to cushion the impact of the VAT increase in South Africa. These may include negotiating better deals with suppliers to keep unit costs low, optimizing logistics to reduce shipping expenses, or like mentioned above to raise a little bit price. By proactively adjusting to these tax changes, companies can better manage their expenses and maintain competitive pricing in their offerings.